Uncertainties and market volatility are becoming the norm. Setting a vision and strategic plans able to resist to such a situation is a complicated exercise for any companies. C-Levels have to navigate this continual and perpetual changes; they, though, must provide themselves with tools capable of tackling these complexity, adapt quickly and engage and connect the whole company towards the new objectives.

Exploiting the huge potential of OKRs and Lean Portfolio Management (LPM) and effectively connecting them by leveraging each other, is the best response to these challenges. Keep reading…

—

Disruption happens and multiplies its frequency, and impact, every day; its effects propagate faster and faster within the inter-connected world we are living. Climate change, Covid-19 and the war in Ukraine are the most recent examples whose impacts are still to thoroughly understand and assess.

In a scenario of continual changes generated in different contexts (business, social, environmental, healthcare, geopolitical), any company needs to develop abilities of great agility in defining strategic plans and pursuing them.

We are convinced that OKRs (Objective and Key Results) and LPM (Lean Portfolio Management) can be of great help in such circumstances.

If we had to pitch it, in the elevator and in 30 seconds, to a CEO we would say this:

FOR Companies WHO need to adapt their strategic initiatives

with higher frequency than in the past

OKR and LPM are powerful management practices based on Agile and Lean approaches

FOR defining company’s strategy and initiatives and measuring results

THAT, unlike other more traditional (outdated) techniques,

SUPPORT C-Levels and their teams in recurrently reviewing and adapting them,

while quickly realign the whole company

OKRs

John Doerr in its seminal book “Measure what Matters” defines OKRs as

“A management methodology that ensures a company focuses its efforts on common important issues in the organization”

While the strategy defines the targets and possible roads the company should walk and KPIs show a snapshot of current measures (like the dashboard of an automobile that shows fuel level, engine temperature and current speed), OKRs can be compared to a GPS. An instrument set for a specific route and which displays every moment where you are in your journey towards those goals.

You need a strategy, you need KPIs, you also need OKRs. The latter does not replace any of the formers.

The key strengths of OKRs can be summarized as follows:

Measuring Outcomes over Outputs

Inspirational Objectives over Generic fluffy ones

Pragmatic and measurable results over Cold and insignificant numbers

Involving over Boring

Vertical and Horizontal alignment over Top-Down cascading

Dynamic over Static

Public and Accessible over Private and Secret

OKRs need to be inspirational but brave enough to require people to stretch although with sufficient confidence of achievement.

OKRs focus on performance of teams, rather than that of the individual. They shall not be confused with individual performance or MBOs (Management by Objectives). They have to remain detached from personal compensation to remain “bold”, otherwise the risk is for people to be less courageous and creative and more conservative in order to easily achieve goals and thus secure the underlying bonus.

An OKR is made of an Objective (OBJ) and 3-5 Key Results (KR):

- Objective: Statement of intent, with a clear focus and direction over time. Inspires and motivates people, providing a clear sense of purpose

- Key Result: Tangible results that quantify success over a specific time period. Must be quantitative and clearly indicate how to measure success. They need to define the best possible outcome, not the most likely one

This is an example of an OKR for a customer service group:

OBJ: Improve satisfaction of our customers with a top-class support service

KR1: Exceed Net Promoter score (NPS) of over 8.2 (6 months)

KR2: Increase good and great ratings from 40 to 60 (6 months)

KR3: Reduce second calls to customers from 35% to 20% (6 months)

Set

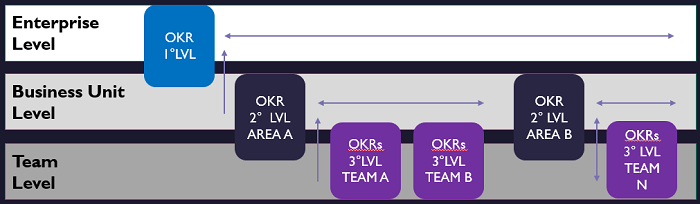

The first OKRs that should be created are the strategic ones at the top (Enterprise level). Then the Business Units brainstorm on how they can contribute to the achievement of that Enterprise OKR and create their own OKRs.

In turn the teams of each BU, first look at their BU’s OKRs and identify OKRs to help that BUin achieving results, however both BUs and Teams should have a look also to other OKRs, ,to see if they can support others as well.

Align

Alignment is not just vertical (see creation above).

Indeed, BUs and Teams have to look at their left and right sides to see if there’s any connection or dependency to keep monitored or any synergies with other entities they can create.

Achieve (and adjust)

Every month, then, OKRs needs to be monitored through check-ins in order track progress and update percentages of achievement; usually every quarter teams ask themselves if those OKRs are still valid or, due to internal or external changed scenarios, they need to be adjusted or even abandoned in favor of new ones.

LPM

We wrote already about Lean Portfolio Management here: “Three Lean Portfolio Management practices your organization should adopt – Now“.

In that post we actually focused on three key practices; however, here we want to focus more on bread-and-butter concerns of such a topic and then talk about it can be connected to OKRs.

Traditional ways of managing portfolios of initiatives usually follows these rules:

- Annual planning

- Centralized and rigid budget definition and assignment

- Project cost accounting

- Focus on measuring outputs (not outcomes)

- Phase-gate processes

- Perpetual overload of demand versus actual capacity

Lean Portfolio Management, on the other hand,

- defines budget buckets yearly but reviews and eventually reassigns them quarterly, decentralizing its management,

- funds value streams and teams with fixed capacity which pursue business objectives, also being able to flex the scope,

- provides monthly syncs and quarterly reviews to check initiatives are delivering value or need to be re-discussed,

- relies on MVPs to achieve 1) short cost estimations, 2) early validation of assumptions, 3) ability to continue, pivot or kill initiatives without waiting for the end of the end of the execution.

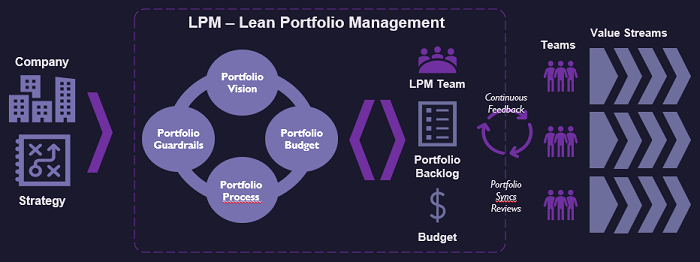

Lean Portfolios collect initiatives aligned to defined enterprise strategic themes and define its own vision.

Budget is assigned to Value Streams according to their strategic relevance in realizing company’s goals.

Initiatives enters the portfolio by following specific guardrails (i.e., dimension, duration, estimates, etc.) and proceed through the Portfolio funnel according to a lean-pull process that aims at increasing, incrementally, the understanding of that initiative and its benefits to evaluate if it is worth proceeding, eventually to implementation, or it needs to be cancelled or parked.

Approved initiatives are then assigned with budget of the belonging value streams, used to fund fixed-cross-functional teams in charge of realizing those capabilities.

How to bridge OKRs with LPM?

Combining the two management practices as follows, is able to multiply their own single intrinsic value. The ones below reported are the tocuhpoints between them:

- Portfolio Goals and expected results

- Initiatives identification

- Initiatives’ benefits description

- Initiatives value measurement

- Matching OKR Check-ins with LPM Syncs and Reviews

Bringing together a subset of initiatives under the hat of a portfolio brings several advantages: faster selection process, better view of the big picture, increased collaboration, better use of resources, better performance measurement, increased time-to-market, decreasing risks.

All these advantages should be clarified, described and always kept into account to steadily increase value creation. Why not describing Portfolio Goals and expected results by using OKRs?

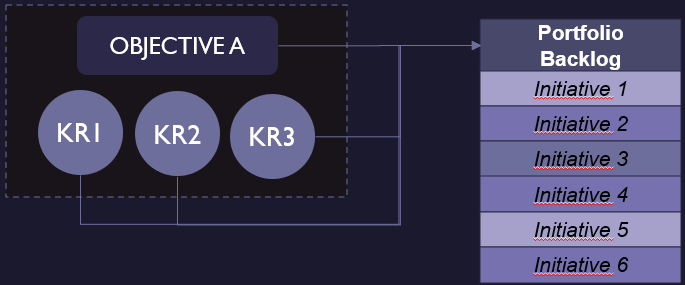

OKRs assure alignment with strategic objectives at all levels while describing what results the company needs to achieve. OKRs, then, should be used for identifying what initiatives can realize those objectives by bring the aforementioned key results. These activities can be managed through LPM.

Each initiative that enters the portfolio funnel can be described by using OKRs to highlight benefits and what key results the initiative should bring in order to have more clarity on how to measure it.

Additionally, as written above, OKRs have to checked-in monthly and reviewed quarterly, isn’t it? Well, why not including these ones into Portfolio Syncs (monthly) and Portfolio Reviews (Quarterly)?

If you asked us what’s the real magic behind OKRs, we would respond that quarterly all the organizational areas are called to review their own OKRs and run again the Align step described. This action “automatically” realigns from within the whole company, actually building the capability of really being adaptive.